If you’re from Mumbai, Delhi, or Bangalore and have been considering your next big investment, Dubai’s glittering skyline has likely crossed your mind. You’re not alone. The idea to buy a house in Dubai from India is more popular than ever, and for good reason. We’re talking about a market that saw a mind-boggling AED 413 billion in deals last year! This isn’t just about owning a glamorous apartment; it’s about making a seriously smart financial choice.

But how do you even start? It can feel overwhelming, which is why we at Maryanne Advisors have put together this comprehensive Dubai property investment guide. We’ll walk you through everything, making the whole process to buy a house in Dubai from India feel simple.

So, Is Buying Property in Dubai a Good Investment for Indians?

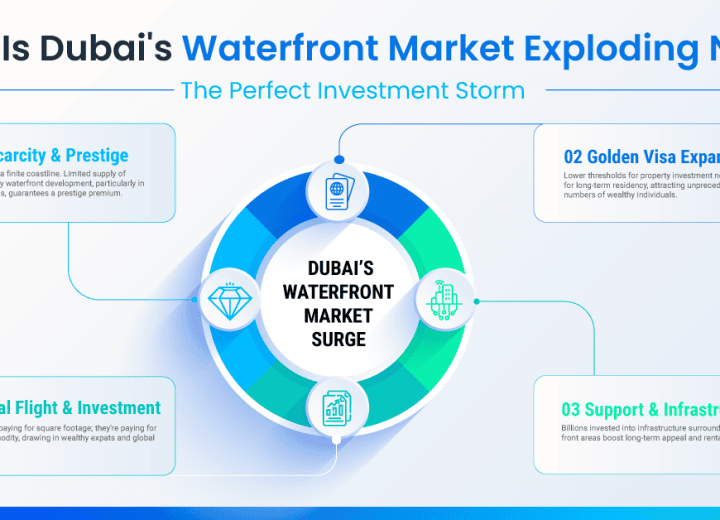

Let’s dive straight into the topic. Why are so many Indians looking to Dubai? It’s not just about the luxury; it’s about the numbers making perfect sense.

Amazing Rental Returns: Let’s talk money. In Dubai, you can expect rental yields of around 6-8%. Back home in Mumbai or Delhi, you’re lucky to get 2-3%. Your money simply works harder for you in Dubai.

Luxury You Can Actually Afford: Here’s a shocker: premium property in Dubai is often cheaper than in our top metro cities. You could pay around ₹29,000 per sq. ft. in Dubai, while a similar spot in South Mumbai could set you back over ₹1.2 lakh per sq. ft. You get more space and world-class amenities for your investment.

The Golden Ticket—Your Visa: This is a huge deal. If you invest at least AED 2 million (about ₹4.5 crore), you can get a 10-year Golden Visa. This Dubai property investment visa gives you and your family a long-term ticket to the UAE. It’s a fantastic perk that adds security to your plan to buy a house in Dubai from India.

It Feels Like Home: With 3.5 million Indians in the UAE, you’ll find a vibrant community and all the comforts of home, making it an easy place to either live or manage your investment from afar. For anyone looking for a Dubai property investment visa, this is a massive plus.

What Mumbai, Delhi, and Bangalore Buyers Look For

We’ve noticed that investors from different cities have different tastes when they decide to buy a house in Dubai from India.

- Mumbai Investors: You’re used to the sea breeze and a high-energy lifestyle. That’s why you’ll love the luxury waterfront homes in places like Palm Jumeirah and Dubai Marina. Budgets typically range from ₹4 crore to ₹20 crore.

- Delhi Investors: You often want more space for your family. Spacious villas and apartments in community-focused areas like JVC or Business Bay are a huge hit. Off-plan projects are also a big draw for you, with budgets often between ₹2.5 and 10 crores.

- Bangalore Investors: Coming from India’s tech hub, you love value and innovation. Smart apartments in up-and-coming tech-friendly zones like Dubai South and Al Furjan are perfect for you. Budgets typically fall between ₹1.5 and 5 crores.

Finding the Best Dubai Investment Properties for Indians

Okay, so where should you put your money? Let’s talk about finding the best property investment in Dubai. While there are many Dubai investment properties to choose from, a couple of options stand out.

You’ll see many ads for off-plan projects, and they are popular for a reason—you get in early at a lower price and can benefit from price increases by the time it’s built. You might come across names like Property Shop Investment Dubai or other specialists.

On the other hand, a ready apartment in a place with high ROI like JVC (7.5%) or Dubai Marina (6.9%) means you can start earning rent right away. Consulting an expert helps you navigate offerings from big players like Dubai Investment Properties LLC.

To secure the best property investment in Dubai, you need a strategy. This is more than just a purchase; it’s about finding the right asset. Whether it’s from Property Shop Investment Dubai or Dubai Investment Properties LLC, having a guide is key. When exploring Dubai investment properties, remember this is the ultimate Dubai property investment guide for a reason.

How to Buy a House in Dubai from India—The Simple Steps

Worried the process is complicated? It’s not. The journey to buy property in Dubai is surprisingly straightforward, especially with Maryanne Real Estate Advisors by your side.

- Find Your Perfect Spot: We help you zero in on a property that fits your budget and goals.

- Lock it In (MoU): You’ll sign an agreement and pay a small booking fee, usually 5-10%.

- Get the Green Light (NOC & SPA): The developer gives a No Objection Certificate, and you sign the main Sale and Purchase Agreement.

- Make it Official (Title Deed): You meet the seller at the Dubai Land Department (DLD), pay the balance and the 4% registration fee, and the property is officially yours! This is the final step to buy a house in Dubai from India.

Working with Property Investment Companies in Dubai & Management Services

So you’ve decided to buy a property in Dubai, but you live in India. Who’s going to look after it? That’s where we come in. A recent report showed that 80% of Indian investors use management services. It just makes sense.You’ll want to find one of the best property management companies in Dubai. As one of the leading property investment companies in Dubai, we handle everything—finding tenants, collecting rent, and keeping your property in top shape.

Here at Maryanne Real Estate Advisors, we aim to be among the top property management companies in Dubai by offering a service that gives you complete peace of mind. Compared to other property management companies in the UAE, our focus is on making your investment passive and profitable.

The goal of the best property management companies in Dubai is to make your life easier, and that’s our promise. We’re proud to be ranked among the top property management companies in Dubai and the wider property management companies in the UAE.

Money Talk: Financing and RBI Rules

- Getting a Loan: UAE banks are happy to lend to Indians, usually up to 50% of the property’s value.

- Sending Money from India: The RBI’s LRS rule lets you send up to $250,000 per person per year. A family of four can pool their allowance to send up to $1 million a year.

- The Best Part? Zero property tax in Dubai. Yes, you read that right! This is a huge win when you buy a house in Dubai from India.

Documents Needed to Buy a House in Dubai from India

Worried about a mountain of paperwork? Don’t be. The list of documents you need to buy a house in Dubai from India is refreshingly short and simple.

- Your Passport

- Your PAN Card

- Proof of income (if you’re getting a loan)

Quick Questions (FAQs)

Q1: Can I buy property in Dubai without a visa?

A: Yes! You don’t need a visa to buy. In fact, buying property is your ticket to getting a visa.

Q2: What’s the minimum I need to invest to buy a house in Dubai from India?

A: There’s no real minimum to buy, but an investment of AED 750,000 gets you a residency visa, and AED 2 million gets you the 10-year Golden Visa.

Q3: So, is buying property in Dubai a good investment for Indians?

A: Without a doubt. The 6-8% rental returns, tax-free income, and growth potential make it one of the smartest moves an Indian investor can make today.

Q4: Can I rent out my Dubai property from India?

A: Yes, easily! That’s what we’re here for. We manage it all so you can relax and see the returns.

Ready to Buy a House in Dubai from India?

The path to owning a global asset is clearer than ever. When you buy a house in Dubai from India, you get amazing returns, a potential long-term visa, and a tax-free investment. It’s a powerful way to diversify your portfolio and build lasting wealth.

The only question remaining is, what might be holding you back?

Call Maryanne Advisors Today! +971 56 853 3111

Visit our Google My Business listing

Get directions to the Maryanne Advisors office